News

Chinabank nets P20.2 billion in 9 months on strong revenues

Posted by SM Supermalls on November 06, 2025

News

Posted by SM Supermalls on November 06, 2025

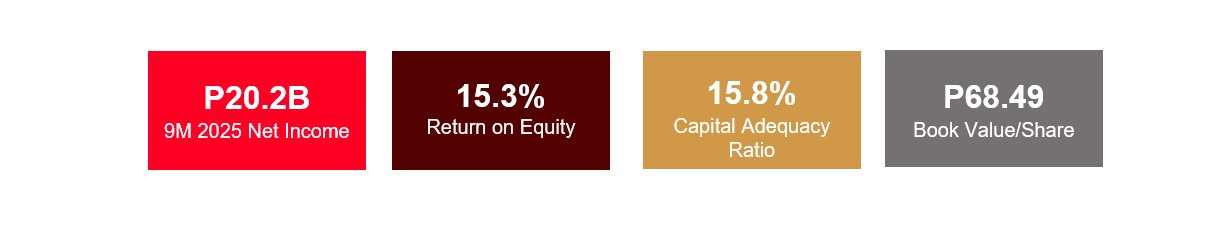

China Banking Corporation (Chinabank; PSE: CBC) sustained strong growth through the third quarter, posting a consolidated net income of P20.2 billion for the first nine months of 2025, an increase of 10% year-on-year. This performance resulted in a return on equity of 15.3% and a return on assets of 1.6%, still among the highest in the industry.

Chinabank’s core businesses delivered robust results, with interest income rising by 13%. This growth, driven by the continuous expansion of earning assets, offset a 9% jump in interest expense. Net interest income grew by 15% to P53.5 billion. Net interest margin remained healthy at 4.6%.

Fee-based income also increased to P3.1 billion on steady growth in trust and bancassurance commissions.

Operating expenses rose by 15% to P25.3 billion, mainly due to strategic investments in manpower and technology. Nonetheless, cost-to-income ratio improved to 45%. To strengthen its balance sheet, Chinabank proactively increased provisions to P7.0 billion for a non-performing loan (NPL) cover of 123%, higher than the industry average.

Still the fourth largest private universal bank in the country, Chinabank’s total assets grew 8% year-on-year to reach P1.7 trillion.

Gross loans increased by 14% to P994.0 billion on strong demand from both the corporate and consumer segments. Despite the rise in lending, NPL ratio improved to 1.6%, reflecting the bank’s prudent stance. Deposits also rose by 9% to P1.4 trillion, securing a stable funding base, driven by 12% year-on-year growth in checking and savings accounts.

Total capital reached P184.4 billion, up 13%. Capital adequacy ratio stood at 15.8% and common equity tier 1 ratio at 15.0%—well above regulatory requirements. Book value per share improved to P68.49.

Chinabank’s strength and preeminent standing in the industry were recently affirmed by several recognitions. Chinabank secured the Four Golden Arrow award for governance excellence from the Institute of Corporate Directors. Its client-focused approach was recognized with the Outstanding Wealth Management Service for the Affluent award from Private Banker International and Philippines' Best Bank for Customer Experience award from Euromoney. Chinabank's growing global reputation was further highlighted by its inclusion for the second year in a row in both TIME's World’s Best Companies 2025 and the Fortune Southeast Asia 500 list.