News

Chinabank nets P13 billion in first half 2025

Posted by SM Supermalls on July 31, 2025

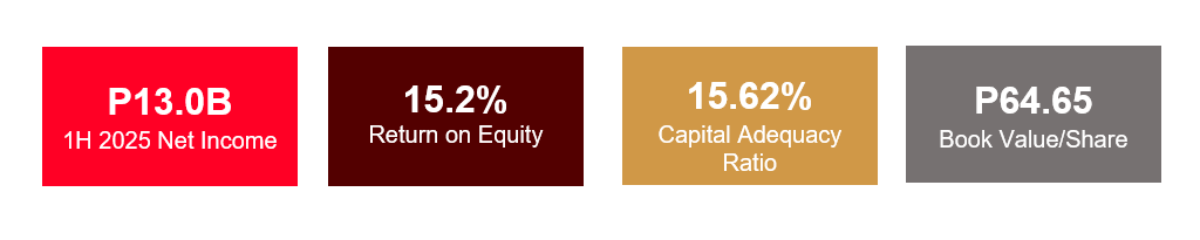

China Banking Corporation (Chinabank; PSE: CBC) registered a net income of P13 billion in the first six months of 2025 on the back of strong core business growth.

The record profits were equivalent to a 14% increase over the same period last year and translated to a 15.2% return on equity and a 1.6% return on assets — among the highest in the industry.

The bank’s total revenues surged by 34% year-on-year to P38.9 billion, mainly from net interest income which grew by 15% to P34.9 billion on higher asset yields and loan volume. Net interest margin improved by 13 basis points to 4.57%.

“We continue to deliver strong operating results in the first semester while supporting the needs of our customers and contributing to the growth of our economy,” CBC President & Chief Executive Officer Romeo D. Uyan Jr. said.

Credit extended to the consumer and corporate segments rose by 18% as Chinabank’s gross loans hit P964.7 billion amid the accelerating economic activities and increasing consumer confidence. Despite a lower non-performing loans (NPL) ratio of 1.6%, well below the industry average of 3.5%, the bank proactively set aside higher credit provisions of P6.5 billion for an NPL coverage of 125%, higher than the industry average of 95%.

The loans growth was funded by deposits, which increased by 5% to P1.3 trillion, underpinned by a 10% growth in checking and savings accounts.

“We are sustaining our growth momentum as we execute our strategy and focus on delivering quality service and value to our clients and stakeholders,” Uyan added.

In the six-month period, operating expenses reached P16.6 billion on higher technology, manpower, and business volume-related costs. With revenue growth outpacing rising expenditures, Chinabank recorded a healthier cost-to-income ratio of 43%.

Total consolidated assets reached P1.7 trillion, marking an 8% increase from the same period last year. Total equity grew by 15% to P174 billion.

The bank’s capital adequacy ratio (CAR) stood at 15.62%, well above the minimum regulatory requirement. Book value per share increased by 15% to P64.65.

“Our robust performance was driven by our commitment to addressing client needs while effectively managing risks and promoting efficiencies. We have ensured that our balance sheet remains strong. Additionally, the recent accolades we received recognize Chinabank’s customer focus and banking excellence,” CBC Chief Finance Officer Patrick D. Cheng said.

Celebrating its 105th year on August 16, 2025, Chinabank was recently distinguished by the ASEAN Capital Markets Forum as an ASEAN Asset Class, an honor given to listed firms that have achieved consistently high scores under the ASEAN Corporate Governance Scorecard. At the 2025 Asian Banking & Finance Awards, the bank won Service Innovation of the Year - Philippines for its pioneering 30-Minute Instant Credit Card Issuance Program and Banking for Women Initiative of the Year - Philippines for the CBC Velvet Visa Signature. The bank was also named among the best Philippine firms in investor relations and corporate management by Extel in its 2025 Asia (ex-Japan) Executive Team Rankings, and among the region’s largest companies in terms of total revenues by Fortune in its Southeast Asia 500 list.